Project by

Carlos Anaya 203 266 1173

Oh, the many wonders of money, my friend! 🌟 When it comes to leading a successful and fulfilling life, money can indeed be a fabulous tool to support you in four essential areas: physical fitness, mental fitness, spiritual fitness, and financial fitness. Let’s dive into how money can play its part in each of these realms.

1. Physically Fit 🏋️♂️🍎

Money can be a game-changer when it comes to keeping your body in tip-top shape:

- Gym Membership: Access to quality fitness centers with diverse equipment and classes.

- Nutritional Needs: Affording healthy meals and possibly even nutritionists to guide your dietary habits.

- Medical Care: Routine health check-ups, fitness trainers, and personal health equipment can all be budgeted in.

- Adventure: Opportunities to explore physical activities like hiking, cycling, or yoga retreats increase with a stable financial footing.

2. Mentally Fit 🧠🧘♀️

Mental wellness is an essential aspect of life, and money can lend a hand here as well:

- Therapy and Counseling: Access to mental health professionals when needed is invaluable.

- Educational Courses: Engaging in workshops, online courses, or pursuing higher education.

- Relaxation and Recreation: Money can provide opportunities for stress-relievers like vacations, hobbies, and indulging in the arts.

- Mindfulness Practices: Subscription apps for meditation or yoga can be budgeted in to keep your mind clear and focused.

3. Spiritually Fit 🌱🕊️

Spiritual health is about connecting with something greater than oneself. Money helps in:

- Spiritual Retreats: Attending retreats or workshops that align with your spiritual beliefs.

- Books and Resources: Exploring spiritual texts or guidance materials to broaden perspectives.

- Communal Contributions: Donating or participating in activities that help enhance communal spirituality, such as volunteering efforts.

- Personal Space: Creating a meditative space at home that is conducive to reflection.

4. Financially Fit 💼💰

Of course, financial fitness is about making sure your money works for you:

- Budgeting and Saving: Money can be invested wisely if you understand budgeting and savings.

- Investments: Getting involved in stock markets, real estate, or other ventures that can grow your wealth.

- Debt Management: Money helps manage debts and creates pathways for better credit management.

- Emergency Funds: Building a financial cushion to weather any unexpected incidents in life.

Using money as a tool, you can create a balanced and enriched life across these spheres. It's less about how much you have and more about how you use it to build the kind of life you truly want. 💪🍀🚀

Money 101: Your Free Step-By-Step Guide

Whether you’re brand new to personal finance or want to dive deep into building wealth – jump right in!

1. School

If you’re considering college, community college,or trade school as an option after high school, this guide will answer your most pressing financial questions:

Is education a good investment for you?

What types of financial aid are available?

Should you take out student loans?

How does the FAFSA application work?

What should you do to prepare for college?

If you’re looking for helpful tips, information, and lists to guide you through the financial aspects of your post-high school education, this guide is for you!

2. Getting A Job

In this guide to getting your first career job, you’ll discover everything you need to know about how the hiring process works and what you can do to set yourself apart from the competition.

This guide walks you through every stage of finding your first career job, including:

What type of job to pursue

How to prepare for a job search

How to find jobs and land interviews

How to nail a job interview

What to consider before accepting a job

You’ll learn how to build an online presence that catches the attention of recruiters and employers, how to find your way to the best jobs, and how to give yourself a significant edge on the competition.

3. First Bank Account

If you’re about to open your first bank account, this article will help you understand how banks and bank accounts work. We explain the different types of bank accounts and show you how to use bank accounts to your advantage, including:

What is interest?

Is my money safe in a bank?

What’s the difference between a bank and a credit union?

How to choose a bank

How to use your bank accounts

You’ll also learn what interest is and why it matters, whether your money is really safe in a bank, and what “FDIC-insured” means.

4.. Budgeting Money

Anyone can build wealth at any point in their life and anyone can go broke, including the wealthy. It all comes down to how you handle and use your money.

This guide will teach you exactly how to use and manage your money, including:

What Is Budgeting And How Does It Work

Is Budgeting Worth The Effort?

How To Budget Your Income

How To Allocate Income According To Your Lifestyle

How To Make Tough Money Decisions

Budgeting is the secret to financial security and long-term wealth, regardless of how much money you earn. So let us help you get started!

5.Credit Cards and Debt

Understanding how credit and debt work means that you never have to end up buried in debt or stressed about upcoming payments. This article will increase your financial literacy by explaining how to use credit and when to avoid getting yourself deeper into debt, including:

Borrowing Money: Is It Good Or Bad?

How To Use Credit To Your Advantage

How To Use Credit Cards Responsibly

How To Get Out Of Debt More Quickly

You’ll also get tips to help you build a high credit score, get out of debt more quickly, and execute a mortgage refinancing strategy that saves the average homeowner $100,000.

6. Wealth Management

The best way to avoid going broke and continuing to build wealth is to understand your full financial picture and look ahead. We're here to help you understand the primary areas to stay on top of including:

Debt management

Retirement

Insurance and estate planning

Should I open a 401k (or Roth 401k)?

Should I open a Roth IRA (or Traditional IRA)?

We want to teach you how finances work, and how to manage finances as you grow, since it is the surest way to avoid losing the money you work so hard to earn throughout your lifetime.

7. TAXES

We want to teach you Taxes

Taxes are a necessary part of earning, saving, and living in this country.

But they’re nothing to fear. If you’re new to doing your taxes or simply want to understand them better, let us be your guide:

What are taxes

Common tax terms to know

Where our tax dollars go

Types of taxes

How to file your taxes

What happens if you make a mistake on your taxes

What happens if you don’t pay taxes

What to do if you can’t afford to pay taxes

Tips to save money on your taxes

It’s been said taxes are one of the two great certainties in lif e, meaning that no matter what you do, where you work, or where you live, you’ll probably have to pay taxes in some capacity. how finances work, and how to manage finances as you grow, since it is the surest way to avoid losing the money you work so hard to earn throughout your lifetime.

8. Buy Your First Home

Buying a home is an exciting time, but you have to be prepared. Learn how to financially prepare for homeownership, how to calculate what price home you can afford, how to navigate your way through mortgage loans and the closing process, and more.

Are You Ready For Homeownership?

How Much Money Should You Save To Buy A Home?

4 Ways To Dramatically Reduce The Cost Of Your New Home

How To Buy Your First Home

Beyond Purchasing Your First Home

Find out everything you need to know about first-time home buying so you can enjoy your home, without regrets, for many years to come.

9. Earning More Money

If you want to put more money in your pocket, then you’ll love the information in this guide. We’ll cover:

Why Should You Earn More Money?

Understanding How Income Is Determined

How To Earn Good Money With A Side Hustle

Where To Get Skills Training So You Can Earn More Money

What To Do When You Can’t Earn Money Fast Enough

You’ll learn how to earn quick money, find a side hustle that pays well, start your own business, and even find employers, clients, and customers willing to pay you.

10. Investing Money

Investing is the true path to a solid financial future. While having a savings account is great for an emergency fund, investing provides passive income for a stable future. This guide will clear up what investing is, and:

Explain basic investing terms

Provide common strategies to help budding investors

Help you build passive income

Show you how to invest for retirement

If you’ve ever wondered what investing is or how it all works, we aim to answer your most pressing questions and help you understand which types of investing will help you best meet your financial goals.

Why ‘Minority Mindset’?

The Minority Mindset has nothing to do with the way you look, your ethnicity, or your skin color. It's your mindset. All success starts with your mindset & we think differently than the majority of people.

11. Ah, the 75-15-15 rule

is a handy guideline many people use for a balanced financial lifestyle. It suggests you allocate 75% of your income to living expenses such as housing, groceries, and transportation. Then, allocate 15% to saving and investing, to build financial security for the future. The last 15% goes to fun stuff like dining out, hobbies, and entertainment.

Think of it as a financial meal plan that helps you balance responsibility with fun, ensuring you're not just living for today but also prepping for a brighter tomorrow! Got any specific questions about budgeting or this rule?

12. Sure, let's break it down! Budgeting can be a bit like a little puzzle, right?

Income:

- Your total earnings before any deductions. This could be your salary, freelance gigs, side hustles, investments, etc.

- It's really the starting point for whether you can save or spend more.

Expenses:

- Ah, the money that flies away! This includes all your bills, groceries, shopping, transportation, subscriptions, eating out, and whatever else you need or want to spend on.

- It's usually broken down into "fixed" (like rent/mortgage, utilities) and "variable" (like entertainment, dining out) expenses.

Savings:

- Think of this as paying your future-self first! It's what’s left from your income after all expenses.

- Some people like following the 50/30/20 rule: 50% to needs, 30% to wants, and 20% to savings/investments.

Let me know if there's anything specific you want more info on or if you're playing around with a real budget!

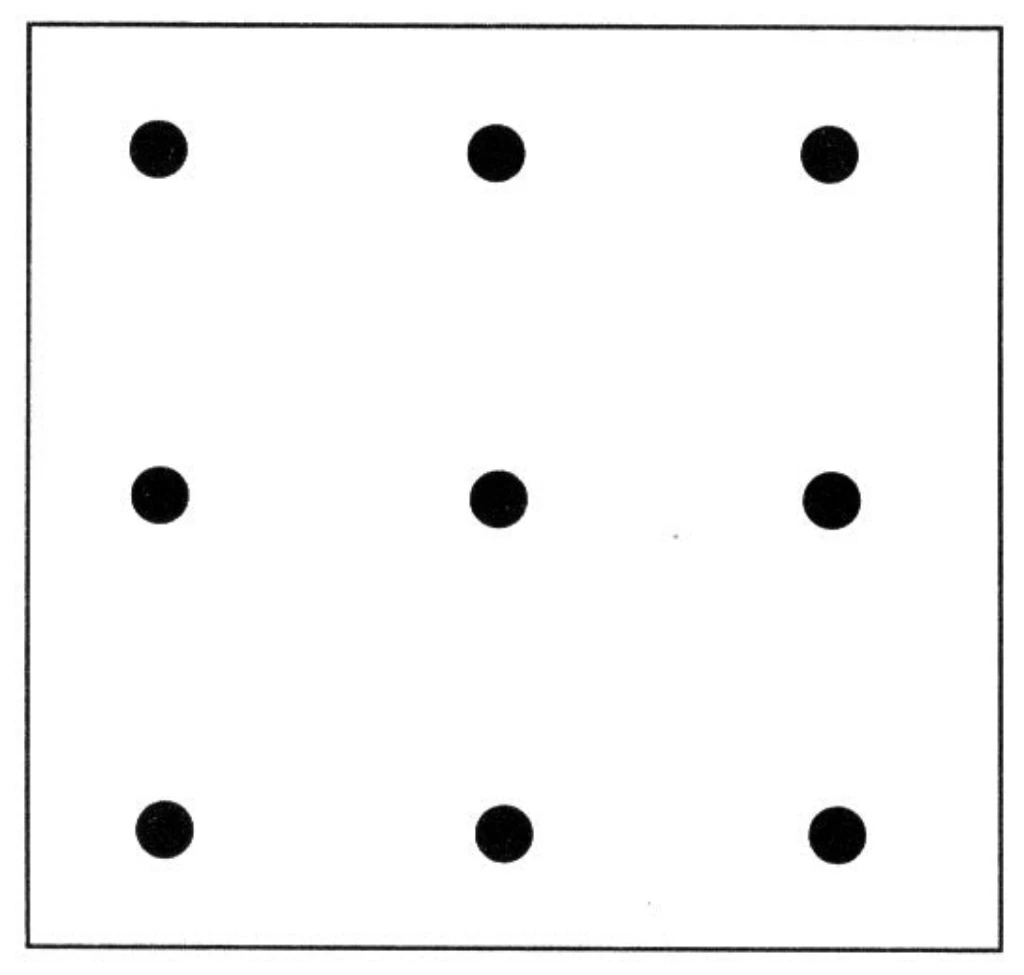

🌟The nine dot problem is a classic lateral thinking exercise that gained widespread popularity in the 1970's and 80's. Participants are presented with a set of dots arranged in a 3x3 grid and challenged to connect all nine dots, without lifting their pencil from the paper, using the fewest possible number of straight lines.

Copy the simple diagram below onto a piece of paper and give the puzzle a try for yourself before reading any further.

The solution requires one to "think outside the box" and while some contend that the nine dot problem served as the inspiration for this popular turn of phrase, others point to a cognitive performance test from 1945 known as Duncker's candle problem.

REGISTER NOW ITS FREE

FREE 2 HOUR WEEK DAY & WEEKEND PERSONAL FINANCIAL LITERACY COURSE/SEMINAR.

ONGOING COURSE

SATURDAY and SUNDAY

Time slots

10AM TO 12PM (onsite)

1PM TO 3PM (onsite)

4PM TO 6PM (onsite)

6PM TO 8PM (onsite)

MONDAY thru FRIDAY

9Am to 11Am (online)

12pm to 2pm (online)

4pm to 6pm (onsite)

7pm to 9pm (onsite)

LOCATION

104 WATERBURY RD PROSPECT CT

AFTER THE WEEK DAY & WEEKEND FREE FINANCIAL LITERACY 1Q 101 SEMINAR IS COMPLETE.

WE HAVE A 1 YEAR PERSONAL FINANCIAL DEVELOPMENT ONSITE ADVANCE TUTORIAL COURSE THAT YOU SHOULD BE ABLE TO BECOME ONE OF OUR MANY STUDENTS TO TAKE FOR ENTIRE COURSE FOR ONLY

$20 PER WEEK.

Do yourself a favor and watch the entire informercial video below.

Than Register

@720creditgroup.zee.am

TO INSTANSTLY REGISTER

Call us at

203 266 1173

Alright, let's dive into the seven money milestones financial literacy crash course that are often highlighted in financial literacy education!

These milestones are steps to help guide anyone on the path to financial wellness, so they're like friendly signposts on the road to mastering money.

1. Building an Emergency Fund**:

Think of this as your financial buffer against life's little surprises, like unexpected car repairs or medical expenses. A good rule of thumb is to aim for three to six months' worth of living expenses saved up. It’s your security blanket that lets you handle emergencies without derailing your finances.

2. Getting Out of Debt**:

Tackling any high-interest debts, such as credit card debt, can drastically improve your financial health. You'll have more freedom and resources to work towards other financial goals once you're not burdened by debt.

3. Proper Insurance Coverage**:

Making sure you have the right insurance is crucial. This includes health, auto, life, and, potentially, disability insurance. Insurance helps you manage risk and protects you and your family's financial well-being.

4. Investing for the Future**:

Whether it’s a retirement account like a 401(k) or IRA, or a simple stock market investment, putting money aside for the future is important. It helps you grow your wealth over time through compound interest, so your money can work for you while you dream big!

5. Homeownership**:

Owning a home isn't for everyone, but if it's a part of your financial plan, it’s a significant milestone. Owning property can be a great way to build equity, providing a potential source of wealth and stability.

6. Maximizing Retirement Contributions**:

Once you're stable, consider maximizing contributions to retirement accounts. These can offer tax advantages and help ensure you have a cushy nest egg for your later years—think golden sunsets rather than retirement stress.

7. Building Wealth and Leaving a Legacy**:

Finally, wealth building and planning for what you'll leave behind involves investments, estate planning, and perhaps even starting a business. This step is about creating financial security, not just for yourself but for future generations.

Remember, these milestones aren’t one-size-fits-all and might not always happen in perfect order. It's about setting realistic goals based on YOUR lifestyle, dreams, and future. Who knows? Maybe you'll be cruising through these milestones like a pro in no time! 🌟

Project by

Carlos Anaya 203 266 1173